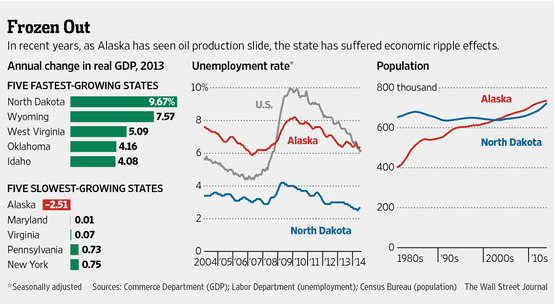

The Wall Street Journal published a terrifying story, datelined in Soldotna, about Alaska’s economy headlined, “In U.S. Energy Boom, Alaska Is Unlikely Loser.” As it points out, Alaska used to be the second highest oil-producing state in the country. Now we’re fourth, behind Texas, North Dakota, and California. Production has dropped 75 percent since its peak of 2 million barrels a day in 1989. The state’s gross domestic product decreased by 2.5 percent in 2013, while every other state increased its GDP. And the state’s unemployment rate in 2013 was 6.4 percent—eclipsing the national average. More people left Alaska than settled in the state between 2012 and 2013, while North Dakota added residents, the WSJ reports.

Here’s a chart that the newspaper put together to go with its story:

It gets worse:

Oil from the U.S. shale boom is making the state’s problems worse. North Dakota is producing so much crude from shale formations that its price has tumbled to about $90 a barrel. Oil from Alaska has been far more expensive, changing hands at about $104.But that premium is already starting to shrink as Alaska is being forced to lower prices. Energy-industry companies and analysts expect prices to further dwindle no matter what happens to the overall price of oil. That means that even if crude prices in the rest of the country remain flat, the value of Alaska’s oil will decrease.

The Wall Street Journal doesn’t get into this, but according to the Energy Information Agency, the state still has about 3.3 billion barrels of “proved reserves,” meaning oil that’s been discovered, is technically possible and economically feasible to get out of the ground. Good news? Not really.

Generally speaking and up to a point, the more activity in an area, the greater increase in proved reserves. Of the four states in the country producing more oil than here, Alaska and California are the the only states where proven reserves declined in recent years. (Though Calfornia’s reserves are widely expected to increase significantly soon, given that state’s vast shale deposits.) Alaska’s proved reserves went from 4.2 billion barrels to 3.3 billion between 2007 and 2012, decreasing 13 percent alone between 2011 and 2012.

In North Dakota, the reserves doubled between 2010 and 2012 to 3.8 billion barrels. That’s not so surprising, given how relatively virginal that state’s oil reservoirs are. Texas, however–a state that’s been punched and punched again with holes–is surprising.

That state’s proved reserves went from 5.1 billion barrels a day in 2007 to 9.6 billion barrels in 2012.

Some of that increase is from new, shale oil finds, but a whopping 3.6 billion barrels are from existing drilling sites. In 2012 in Texas, there were 23 new oil discoveries and 57 reservoir discoveries in existing fields.

Alaska had zero of both in 2012.

Contact Amanda Coyne at amandamcoyne@yahoo.com

Hahaha … Katchen, darned auto correct.

Ahhhh, it finally dawned on me … Jon Kitchen. Now I understand the comments and why the bias. I will say this, I thought your Dispatch piece supporting No on 1 was one of the best. But the comments here, not so much. You are dancing too fast trying to defend all of the old DNR policies. Sometimes you just need to let them go.

Many resource development projects are outside of the state’s control. The most lucrative leases are held by the Feds. ANWR is locked away and Alaska won’t benefit from any drilling in the OCS revenue wise until Senator Murkowski’s revenue sharing bill passes congress. The fact of the matter is that the state’s policies have little effect at the end of the day, because they don’t have jurisdiction over lands where the majority of Alaskan oil is.

Additionally, in terms of state revenue, mining does very little for state coffers. The mining tax is fairly antiquated and since Alaska has no sales, property, or income tax (not that I am advocating for more taxes) the state revenue from large mining projects is negligible.

This article is very informative. I appreciate your time to share this. Alaskans need to see this information. Our economy is very dependent on the oil sector. I just don’t understand the hatred that Democrats seem to have towards the industry. Thank you for sharing.

Lynn,

You don’t get it. Mayor Sullivan in 2013 was telling us to prepare for rolling blackouts. ENSTAR was saying it was going to have to import LNG, which would have TRIPLED your home heatjng bills. The world has changed. Not only are gas supply contracts locked up until 2018, but Hilcorp keeps drilling. Furie is installing a new platform that they say can produce 100 McF/d. Other companies have made massive discoveries. We are not going to be importing LnG any time soon. All of this happened bc of policies enacted and implemented over the last 6 years or so. Our legislators and governor deserve credit for this success – talk to anyone on the Kenai about the turn around, it has been remarkable.

We are seeing the same thing on the north slope. And we are seeing mining companies commit significant capital to expand existing mines all across the state and in developing new mines in SE, SW, NW, and in the interior. Do you have any what this means to the people living near Ketchikan and Juneau? Those living near Donlin, Red Dog, Livengood, Fort Knox, and Pogo? Let me spell it out: good paying jobs and cheaper energy.

Jon,

I wish I could be so optimistic. Since the legislature and Governor Parnell refuse to control state spending, we need ever increasing sources of revenue if for no other reason then to replenish our savings accounts.

I would like to know how much state tax revenue we are now realizing from Cook Inlet. I do know that all that state money has resulted in firm supply contracts only through 2018, very expensive gas from CINGSA, and very unstable consumer prices.

How many of Parnell’s 16,000 jobs are in mining as compared to government or state contracts for government services? Also, how much tax revenue are these mines producing?

And how many North Slope Pipeline projects should we be paying for now that the AGIA restriction of 500 million cubic feet per day has been lifted?

I know….”Don’t Worry – Be Happy”.

Lynn,

Out policy makers averted disaster by passing laws to attract capital and companies to come to the Cook Inlet. It worked. Instead of importing LNG, which would have tripled your heating costs, we are now seeing a ton of activity, which means jobs for Alaskans, energy for our homes, and revenue.

The same activity uptick is occurring on the north slope. The momentum is building all across the slope with billions in new investments.

Mines from pogo to red dog to Kensington are dojng great – they are adding a lot of great paying jobs all across Alaska. And we are just scratching the surface. Donlin will bring huge value to SW Alaska. Wake up. There is a lot of positive news.

I suggest my mentality is very reality based. According to the US Energy Information Administration website, Alaska has gone from producing 25% of America’s oil to 7%.

Now increased supply is lowering crude prices so if these new “staggering amounts” of hydrocarbons are not economically competitive or can’t produce sufficient tax revenue to provide our present need for funding, then what? That is the question this state government had better address.

Many of the same folks who thought ACES was “aces” now bring you SB21. While production decreased our state government did virtually nothing to diversify our economy and over the last few years created the largest state budgets in history requiring us to pass into deficit spending. Perhaps they made the mistake of believing their own propaganda.

I will vote “NO” on repeal because we are facing a fiscal disaster and I believe we are now in no position to dictate terms. Voting “NO” puts me in a “win/win” position because if SB 21 does work we avoid the fiscal cliff while if it doesn’t solve the problem I will know for certain that the members of the party now in power have no idea of how to govern this state.

Lynn,

According to th USGS we still have staggering hydrocarbon and mineral potential across the state. The development of these resources will keep the state’s economy healthy for decades. This is just a fact. The only way this state will have a vibrant economy for years to come is by attracting companies and investment. Your doom and gloom mentality simply isn’t reality based – at least if we don’t scare off investors and companies by repealing SB 21 and reconstituting a tax system which will bring in LESS revenue than SB 21 according to ISER’s recent report.

Already I am hearing that this information simply cannot be true and in any case our best days are before us. Juxtapose that graph showing Alaskan unemployment now matching the US rate and ask yourself how can that be when the current Governor is claiming he created 16,000 jobs? Please don’t, at the same time, dwell on the spending that has occurred over the last five years to help create those jobs with the resultant fiscal condition of the state or your head might explode.

Is decline not the ultimate legacy of exploitation of any non-renewable resource? Do you not believe that someday North Dakota will face a similar decline and do you not think other regions of the nation, unlike Alaska, encouraged diversification of their economies because they were perhaps smart enough to do so? Not we Alaskans because we just know that the old oil and gas goose is immortal and full of gold eggs. Look at this year as the PFD amount doubles. Don’t you think our courageous leaders might have at least frozen the PFD amount knowing the problems that face us?

And what do we want to do now? We want to, apparently as soon as possible, export our natural gas with minimal processing for others to use to create products and jobs.

Keep voting for the status quo and that is exactly what you will get. We really do need to change the state song from “Eight Stars of Gold” to “Don’t Worry – Be Happy” and forget that PFD comment because I need new snow tires and a little extra to pay for natural gas even after the “Cook Inlet Renaissance”.

And look what they’ve done to their states in order to extract that oil. Destroying ground water, passing laws against disclosing the use of dangerous pollutants, muzzling citizens who object to dangerous and dirty practices. Are they getting any money from it? The only state I hear about that is making money is Colorado, from its legalization of pot.

We have production that is relatively clean and relatively safe and is not yet tainting the waters of our state. When TAPS was built they predicted 40 years worth of oil. We are past that date and producing more than the oil companies expected at this stage. The fact that we haven’t had a major blow-out in all those years is a testament to good engineering and good regulation. You needn’t be terrified Amanda, at least not of the gradual decline we’re seeing.

Why some of the Democrats hate oil companies is startliing. Their personal agenda to hurt the industry is troubling and sick. I admire Democrrats who have the courage and common sense to take a stand to benefit our state’s economy. One of those individuals is Kenai Borough Mayor Mike Navarre. Thanks for your leadership. Our party is so weak and is further weakened by some who are obsessed with hating the oil industry. Vote No on #1.

This article should cause pause and concern for every Alaskan. Likewise, it should be required reading for everyone voting in the August 19th primary. Great job bringing this information to our attention.

This is another indication that ACES failed. But here is the good news – we now have about 15 companies pursuing drilling programs on the North Slope, the number of active players has accelerated in the past year, the small independents now have money to pursue their projects, and companies are pursuing projects west in the NPR-A to the boarder of ANWR and from the Chukchi Sea to Umiat.