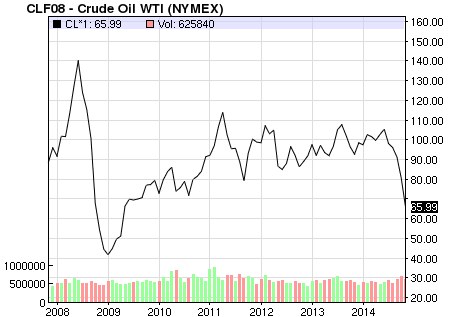

Here’s some not-so-cheery news to for your Saturday. Brent crude futures was trading at $70.15 a barrel on Friday and West Texas Intermediate crude oil dropped to $66.15.

That said, reader Jon K. says there’s reasons to be optimistic in Alaska. He culls from Friday’s Petroleum News to make his case: (Links added by me.)

Liberty again: Having purchased a large slice of BP’s interests in four BP northern Alaska oil fields, Hilcorp Alaska is going to file a new proposed plan of the development for the Liberty field, offshore in the Beaufort Sea. Hilcorp has acquired a 50 percent interest in Liberty and is now the field operator. ….Essentially, on the North Slope Hilcorp will adopt the same strategy as it has been employing in the Cook Inlet basin, where as a consequence of a multitude of small development and upgrade projects the company has doubled oil production from the aging fields that the company acquired from Chevron and Marathon.

Another rig for Kuparuk: ConocoPhillips Alaska has contracted with Nabors Alaska Drilling for a new coiled tubing drilling rig, the company’s president, Trond-Erik Johansen, told the Resource Development Council’s annual conference in Anchorage Nov.

Increased activity. Since 2012 BP has increased its North Slope activity level by more than 50 percent – the company is on track to add an additional drilling rig operation to its operations in 2015, with a further rig due to go into action in 2016, Weiss said.

Repsol spending $240 million this year: Repsol E&P USA Inc. plans to spend $240 million on its exploration work this winter.

Caelus planning to spend $500M in 2015 on Slope exploration, development.

Armstrong left ‘a lot of money on the table in recent lease sales, but worth it to advance development.

Oil industry employment hits records. Employment in the Alaska oil industry looks set to hit a record level again this year, Neal Fried, an economist with the Alaska Department of Labor, told the Resource Development Council’s annual conference on Nov. 19. Apart from 2010, each year since 2007 has marked a new record for employment levels in the industry. The employment level in the North Slope industrial complex is particularly impressive, with an increase of about 1,200 in personnel compared with last year.

This is really just a restatement of the “resource curse”. By the way, you have not answered the bonus question nor any other questions I have asked.

Apparently my submissions are now being censored . . . this is my second attempt at submitting this post . . .

Again, this is nothing more than a restatement of the “resource curse”. You still have not answered the bonus question . . . much less anything else I have asked you excellency about.

Cheers!

From “An Introduction to the Economy of Alaska”, at p. 43 (Dr. Gunnar Knapp, Institute of Social and Economic Research, Feb. 2012): “The ‘Alaska Disconnect.’ Alaska’s fiscal structure—specifically the fact that Alaskans do not pay any significant broad-based taxes—leads to a problem which has become known as the ‘Alaska Disconnect.’ If economic developments creates more jobs, Alaska’s population grows. As the population grows, Alaskans need more schools and teachers for their children and the other services that state and local governments provide. Although the new Alaskans pay local sales and property taxes which support local services, they don’t pay broad-based state taxes to cover the cost of state-funded services such as education and roads. The new jobs create new costs for the state but not corresponding new revenues. As a result, except for oil development (which pays high state taxes), many kinds of economic development make the state’s financial situation more difficult. “

Hilarious. You did not answer one of my questions and apparently have no capability to do so. The wizard of oz would be proud!

Cheers.

Let us not once again be lured by the siren song of promises. Unless these announcements of gas and oil activity directly result in state revenues they are of no use. Also, if the legislature is going to ask to reduce the requirement for royalty payments (as they are discussing) to encourage production of marginal prospects, how much will that incentive reduce the net gain to the state when the loss of royalty revenue is deducted from any tax revenues?

Speaking of promises for future revenues, the ADN reports that only 20 of our 60 legislators signed the necessary confidentiality agreement to be informed of the AKLNG project status. Legislation to proceed with the AKLNG effort (SB 138) passed by a vote of 52 to 8 yet apparently now only 20 of the 52 supporters are demonstrating the direct interest I would think is extremely essential as we progress in this effort. This legislation involves us as an equity partner; therefore, these legislators have a fiduciary responsibility to remain as informed as would any member serving on a corporate board of directors. The supporters of SB138 claimed that this secrecy was absolutely vital so I cannot understand why any of them would not be participating in this agreement.

I could understand those who will not be in Juneau this January not signing; however, what about the rest of them ? Is this lack attention caused by a loss of interest in this critical (and very expensive) effort already? I would argue that sending a staff member to this kind of briefing is a clear indication that the staff member should become the actual legislator.

The decision to add rigs at Prudhoe was made about 18 months ago, well before oilcos knew the results of the Measure 1 vote on SB 21.

Most of the folks commenting seem to miss the point that the recent oilco investments in AK were made well before oil prices tanked. Adding rigs, new developments, etc are planned years in advance. Much AK production is only marginally economic at $80/bbl.

So just that I have this straight, your point is that its OK for Alaska to continue burrning through the savings needed to support future generations because …. someone that can’t even use their own name to post says the law of supply and demand is going to be suspended because the “world is going to burn” and he/she is smarter than EIA and IEA. Hmmmmm, I think that’s how the state got in this shape in the first place. Some coming up with various rationalizations du jour so that they can continue spending regardless …..

A gentle correction: What you are likely referring to is the “Resource Curse” rather than your made up “Alaska disconnect” . . . if you simply google those two words together you will find a nifty definition. Being well read also means that one should cite their references rather than usurping the ideas of others.

Bonus question: What Alaskan PhD candidate thesis examined this in detail w/r/t Alaska?

Cheers!

By the way, please inform us all of your expertly calculated econometrics detailing the EIA and IEA’s ability to accurately forecast the future. Oh, thats right. You can’t solve for that because they are terribly ineffective organizations at forecasting.

Cheers.

To clarify the terrible formatting, the numbers above are to be split in the following categories:

Selected Petro States / Break Even ($) / % World Reserves

These countries make up 83.44% of known reserves . . . and break-even on current budgets are almost all above $80 – even taking into account a draconian 20-30% cut in spending.

Cheers.

If oil does not rise above 80, the world is likely to burn. Too many mouths to feed. Too much coming demand from the less developed countries. World demographics will not see peaking in major economies such as China before 2025. Until then they and other economies will endlessly add multitudes to the middle class. True it takes four Chinese middle class spenders to equal one US middle call spender (thus consumer of energy), but they and the other major population centers have a population to overwhelm supply.

Selected 2015 Break- % World

Petro States Even ($) Reserves

Libya 184 3.25%

Venezuela 151 20.03%

Yemen 145 0.20%

Algeria 131 0.82%

Iran 131 10.59%

Bahrain 127 0.01%

Alaska 117 0.22%

Russia 107 5.37%

Saudi Arabia 106 17.84%

Oman 103 0.37%

Iraq 101 9.68%

UAE 77 6.56%

Qatar 60 1.69%

Kuwait 54 6.81%

=83.44% Total World Reserves

Source . . . MEES, IMF, State of Alaska

Cheers.

Jason B. – Loolk in thje mirror Dude. Are you crazy? Yout commentary is laughable. Who made “YOUR” point of view correct?

I think Alaska would be a much better place without political extremists like you. I also think that getting rid of the liberals, like you, will do littte to improve our polirical environmment. We’ll also need to get rid of the right wing conservatives. Idealogues are what’s bad for the state – – both the left and the right. By the way, take a course oin economics if you’re going to continue to comment. Might help with your arguments. Oops. If I offended you by calling you a liberal, my apology.

You need to read more. Both the federal Energy Information Administration and the International Energy Agency have said that we are in the midst of a paradigm shift in oil prices and that the “bounce back” some anticipate in oil prices will be to the $80 level, not above. The reason that the indistry is still investsting is because they can still make money in the $80’s. The current Alaska budget, on the other hand, is balanced on $117 oil. Prices indeed may rise soon back to the $80’s, but even then Alaska will still be running a $3 billion annual deficit. To put it simply, Alaska let it’s costs get out of control based on the assumption that high oil prices would never end. In retrospect, the industry — and most other petrostates — were a lot more cautious. We are going to pay a significant price for that,.

This is a great example of what economists call the “Alaska disconnect.” The Alaska state budget is driven almost entirely by two things — oil price and production. Even if other economic sectors remain active, state government still suffers if either production or price fall. In the current environment the fall in price is overwhelming everything. At current price (and thus, royalty and tax levels), production would need to rise (immediately) to roughly 900,000 barrels per day (v. 500,000 currently) to balance current state spending. That, of course, is not going to happen — the best we can hope for in the current environment is that the decline slows from 6% to 2 or 3%. I think it’s great that the industry activity Jonathan describes is occuring and hope it continues. But no one should think its going to make any material difference in where the state budget needs — and sooner or later will — head under the current price environment.

Hi Roxanne, I almost never engage with name callers but since I object as a Democrat to being called a ‘hater” here it goes. We Democrats are your friends, neighbors and relatives, in a way just like gay people are. We work, pay taxes, raise kids, volunteer, own businesses, go to church and try to respect all other peoples and their beliefs. I don’t know any D’s that are “haters”, but we do get frustrated with people who don’t listen or try to understand our different point of view. We are mostly bemused by our Republican counterparts as we wait patiently for more Alaskans to come around to our point of view. I will admit that I believe that I’m smarter and have a broader world view than most Republicans but then most of my Republican friends believe the same thing about themselves. I have come to believe that liberal and conservative brains are indeed wired differently from an early age, mostly but not always influenced by our parents views.

Oil production declined 40% under ACES and if ACES were ever put back into place we’d never again see the revenue it once generated. Today’s production levels and price forecasts won’t support it and we’d likely resume the production slide. At least SB21 gives us a chance at climbing out of that hole. Lease sales are up, new investment is back, new production projects are up, new players are coming to the slope, and employment and wells are at record levels. The wind changed dramatically as soon as SB21 was enacted. If ACES was so great, why did all these positives kick in as soon as it was ended? SB21 earned a chance to prove itself and trying to rehash the election by attributing today’s successes to yesterday’s failed legislation gets hollower every day.

Occam’s Razor applied: Why are oil companies investing so much money in Alaska if oil prices are crashing? Why would Shell even waste a nickel on the multi-billion dollar bet that is the Chukchi? Why is anyone still talking about The Big Pipe?

Because prices are going back up and soon. Fracking is expensive and all the easy oil from the Dakotas has already been pumped. Demand in India and China is going through the roof and no one trusts Putin. Once Obama leaves office – 25 months – the domestic economy will explode and our demand will increase, too.

Oil companies, especially the big ones, aren’t prone to making huge mistakes. They have whole buildings full of people who do nothing but run these calculations. They will be back in Juneau this spring crying poverty but just follow the money, look at their plans. Our budget crisis is temporary and probably allow the State to prune off some dead limbs.

The arguments in favor of SB21 used to be that the insatiable growth of the state government was stifling oil investment. The state was yelling, “More! More! We need more!” while the poor oil companies were faced with making less and less money even after investing more and more. Now were are to believe that SB21 is “working” since it brings more money to fund the insatiable government state than ACES would have. This is a complete reversal of position for the supporters of SB21. And, just to doubly prove how well SB21 is “working” the oil companies, we are told, are pouring in investment in even in the face of lower oil prices and paying a higher percentage of their diminished income to the State of Alaska. In other words, they are investing more to earn less. Before the election pretty much everyone guessed wrong about the direction oil prices were headed but it seems Alaska was and is a good place for oil companies to invest regardless of taxes or even oil prices.

Jason B – while you are entitles to your opinion, I hope that you’re just unwilling to accept the fact that SB 21 is working and that, pray God, that you’re not that stupid. You may be right that someday oil prices will soar and the state won’t get as much revenue per barrel; however, hopefully we’ll have higher production and will make up the difference that way. The bottom line, we are all Alaskans and basically have the same values, hopes and dreams. We all want what is best for the state; however, I don’t see how hating the state’s biggest economic driver is healthy for our economy. The election was held, a decision was made. I didn’t vote for Walker but now I’m rooting for his success. I’m not trying to do him in because my guy lost. I really think you are unwilling to look at the facts. Take care and hate the oil companies all you like. Saying that SB 21 isn’t working just makes you look either stupid or ill-informed.

Rich L. and CPG49- dems, moderate r’s,independents, liberterians and especially independent thinkers all opposed SB-21 and still do. We lost that fight $15 million to $600 thousand but none of our arguments have changed. Yes we may be ahead by tens of millions now but we will be behind by billions when oil prices go back up. None of the other anti-SB21facts have changed or been disproven. Nobody has forgotten that increased activity on the North Slope started in 2007 before ACES passed and that it is a convenient coincidence that additional investment has been happening in aging and declining fields that had been neglected for years.

@Casey. That was my fault. It’s fixed.

Not sure why you wouldn’t use this link for the Caelus announcement since that is where the $500 million number comes from.

http://www.petroleumnews.com/pnads/640134806.shtml

Permanent shift in the supply curve, permanent shift in the demand curve… in this case, both in the wrong direction for heavily leveraged, price dependent sovereigns like Alaska.

Not the end, not good either…

All I can say is thank goodness for SB 21. Thank you REpublicans for fighting on behalf of our state’s economy. The facts show that you were right. Does anyone ever think we’ll hear an apology or well we were wrong from any of the Democrats?

@Jon, Every single dime of oil revenue that the state spends comes right out of the tax payers pocket. Yes we are tax payers, that oil does not belong to the state. It belongs to the people of the state so, whatever portion of oil revenue the state syphon’s off for it’s operations is nothing less than a tax on the people of the state.

Well, apparently the sky IS falling.

However, it does not mean that eternal doom and damnation is upon us. It does mean that the State of Alaska is now going to be required to make some of the hard choices that it probably should have made many years ago. We must be willing to look at where our spending is going and decide what is really needed as opposed to what is really wanted and then we will have to do the hard thing, end programs and services that are not in the needed column.

I am sure that there are many different programs that folks will volunteer up as something that needs to go and I thought I would open a discussion with something I have long thought was clearly a needless waste of resources and also a clear disservice to the students involved.

Education is a ‘sacred cow’ and any of us could hold forth at some length as to why we are not spending enough money on education. However, in reality, we can safely assume that we will no longer have the option of spending more money on anything. So, let’s think about the state’s budget for education and how we are spending it…. We have hundreds of schools in rural Alaska that offer students a consistently poor education while at the same time manage to remain far more expensive to operate than any other option. At the same time, the state operates Mt Edgecombe, a boarding school in Sitka that has consistently offered high quality education to its students. There are several facilities around the state that would be quite cheap to convert to modern boarding school campuses that could operate far cheaper than the unsustainable system we have now and if he Mt Edgecombe model is used most likely provide the first chance at a first rate education that many rural students will have ever seen.

Jon K,

You have some fear…? The globe is in an oil supply glut and no one is in the mood to cut production. In fact, as price falls, Mexico, Russia, Venezuela, Nigeria all plan to increase production to meet debt payments. Until peace breaks out and Putin stops thinking he is a conquerer of land and nations, the global economy is going nowhere fast. Who really knows what is going on in China or how its oil demand is going to play out. If prices keep falling, we can forget about investment in new production and let us pray to keep the exploration investment. If prices keep falling, there is going to be a lot of bankrupt Fracking oil companies littering the country and very upset investors.

In one of the greatest economic backfires in human history, President Obama’s war on hydro-carbons by driving prices artificially high has generated the greatest investment in hydro-carbon production in human history. On the plus side for President Obama, the US is more efficient than it has ever been in the use of energy and there has been significant research and development that will continue to reduce domestic demand.

Oil is abundant and easily produced while demand is flat or in decline. I have not heard a single economist predict global GDP growing at a rate fast enough to offset existing, let alone new oil production. Alaska needs to act is if this crisis is not short-term or temporary. Gradualism in regards to budget reductions will be the wrong strategy… cut now, cut deep will in the long-run, be the right strategy for the Walker Administration.

Without the passage of SB 21, Alaska would be in a world of hurt. SB 21 generates more revenue at the prices we’ve seen since implementation. The lease sale that was held recently was the biggest in 20 years and activity on the slope is booming.

Still, some call it a give away? That just doesn’t make sense. The Dems have a hard time saying that they were wrong.

Just to be clear – I am also filled with fear. We are going to be in a world of hurt if the prices continue to fall or stay below $85 for a sustained period.

That said, there some reasons why we don’t have to abandon all hope –

1) activity and competition on the slope continues to build

2) we have over $60 billion in savings and residents don’t pay a dime for all of the services the state provides

3) the fiscal nightmare will force the state to kill dumb capital projects and hopefully find a more sustainable operating budget – in particular come up with smarter ways to bend the cost curve on health care.

4) at some point oil prices will rebound.