Here’s some bad, some good and some interesting news gleaned from the Revenue Sources Book Fall 2014, which the Department of Revenue released today.

Here’s some of the bad:

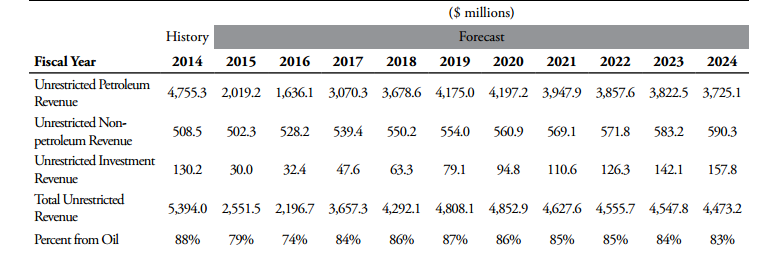

In FY 2014, the State received $5.4 billion in revenue from unrestricted sources, $4.8 billion of which came from petroleum related activities. For FY 2015, the department is forecasting a significant decrease in unrestricted general fund revenue to $2.6 billion.

Here’s a chart which brings it home:

Brad Keithley, as he’s wont to do, has his way with the numbers:

FY 2014 deficit: $1.8 billion (budget 25% financed from savings); projected FY 2015 deficit: $3.7 billion (budget 60% financed from savings); projected FY 2016 deficit under Parnell “work in progress budget”: $3.3 billion (budget 60% financed from savings). Savings remaining at the end of FY 2016 under the Parnell “work in progress budget”: ~$6.5 billion

More bad:

The department projects ANS oil prices will average around $76 per barrel in FY 2015 and $66 per barrel in FY 2016. In the longer-term, the department forecasts ANS to increase over $100 starting in FY 2018.

Now for some good news, which many, particularly the oil companies and AOGA, are using as evidence that tax reform is working:

Another change is that we now have a trend for higher production than previously forecast. Between FY 2013 and FY 2014, North Slope oil production stayed steady and for the first time since 2002.North Slope oil production between FY 2013 and FY 2014 held steady, and it is expected to increase by approximately 15,000 barrels per day and 10,000 barrels per day in FY 2016 and 2017, following decline of 22,000 barrels per day in FY 2015. Given the forecast in investment trends, we expect that oil production should remain above 500,000 barrels per day for the next three fiscal years.

More good news:

Three main North Slope oil producers and the State of Alaska are working on a preliminary project concept whose current estimated cost is at least $40 billion for a 42-inch pipeline from the North Slope and an LNG export facility in Nikiski on the Kenai Peninsula. A project of this scale would likely subject the Alaska economy to growth rates that are unprecedented, even taking into account the previous North Slope oil boom.

Great news:

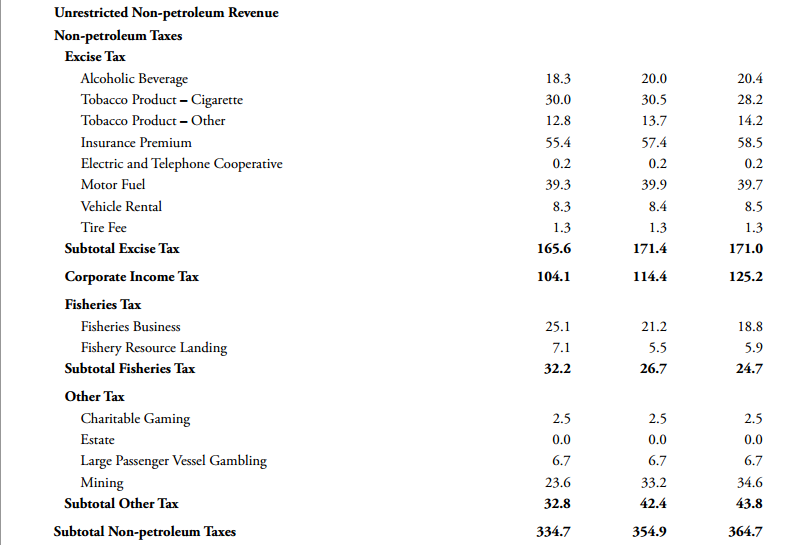

In recent years, the total number of cigarettes purchased in Alaska has fallen by about 20 million per year, translating to a roughly $2 million yearly decline in cigarette tax revenue.

Interesting news:

Alaska over the past 5 years, wine consumption has grown at an annual rate of 2.25% and liquor consumption has grown at an annual rate of 3.7%. Consumption of beer, cider, and malt liquor has grown at an annual rate of 0.4%, and the share of these beverages produced by qualifying small breweries is steadily increasing, from 17.4% in 2009 to 27.1% in 2014.

Interesting chart. These numbers are for fiscal year 2014, 2015, and 2016. Notice in 2015, the state is projected to collect $17.5 million more from taxes on tobacco than on fishing. In 2016, that number jumps to $17.7 million. Taxes on tobacco overtake mining taxes by $11 million in 2015 and $7.8 million in 2016.

Contact Amanda Coyne at amandamcoyne@yahoo.com

Great point. Whenever a bank teller says your account is overdrawn you should always demand they tell you where you should spend less money.

This is simply not true – one of the selling points during 2013 was ACES wasn’t sustainable and that at low prices the state has huge exposure. It was in every presentation before the legislature. The press never, or rarely covered it. During the repeal campaign many of us also made a huge point that below $105 the state was better off relative to ACES and we made a huge point that we needed to eliminate the capital credits to prevent major revenue shortfalls.

Alaska continues to subsidize commercial fisheries management to the tune of $60 million plus.

Fisheries taxes, business and landing, is about $25 – $30 million, but that revenue is roughly one third the cost of commercial fisheries management, not including state infrastructure for ports, hatcheries, remote airports that service primarily commercial fisheries…

Fish are a public resource to be used for the maximum benefit of the people of the state.

Commercial fisheries utilized 98.2 percent of all fish and game harvest in Alaska in 2012, or 3,240 million pounds. Private use (commercial profits) is subsidized by $50 – $60 million plus annually drawn from the state general fund, over and above monies generated by the current fisheries taxes. In 2012, the $50 – $60 million subsidy generated about $1,300 million in ex-vessel values (harvesters) and $3,500 million in first wholesale value (processors + harvesters).

For each pound of commercial fish product leaving the state it generated roughly $1 of revenue.

It cost the state about 3 cents a pound to manage these fisheries, of which the commercial fisheries tax revenues generated about 1 cent per pound.

It will be up to the Legislature to determine if the seasonal and low profit margin commercial fishing industry can afford any increase in their tax structure, or should the state continue to subsidize this industry, or should it look to cut overhead management costs, which could threaten the future sustainability of the fisheries or force them into more conservative management regimes from less comprehensive management and oversight.

Looks great now, but the reason it isn’t/wasn’t talked about was because ACES took TOO MUCH according to you, AOGA, and the NS producers. “Too much, too much, too much!” was the cry. Nobody campaigned heavily on SB21 saying that “this is a great deal when oil hits $60/barrel!” No one associated with the industry ever saw this coming, and didn’t want to ever think about that depressing of a scenario, so it just wasn’t part of the multi-million $$ campaign and message. So keep crusading.

Westlake,

Dwarfs in comparison, damn straight. I am flabbergasted that Alaskans continue to harp on this mantra of ” our fair share”, and they only see one part of the economy. If we are indeed a proxy state, where the citizens own the resources, then why are we not taxing all proxy owned commodities at the same rate? Given a dollar worth of fish, gold, and oil ( all proxy owned commodities ) we should be getting 33 cents from each source for the market value of the commodity produced. Currently, for every tax dollar collected, evil oil is paying about 94 cents, and mining / fish pay about a half penny each.

The cost of all the state employees and other expenditures exceed what they bring in as taxes. Jobs you say? Maybe for a few months, then they go on unemployment in far away places. The lobbyists and their political hacks in Juneau are laughing all the way to the bank.

The problem is the joke is on us……….

I appreciate hearing from the “apologists” who are desperate to rationalize the unsustainable spending of the last few years as necessary to protect us from recession or how legislation relating to oil taxes and a promise of a gas pipeline is all we need to recover. According to them all we have to do now is wait for this “supply side” recovery plan to “trickle down” to the state. Looking at requests to the state for tennis court roofs and golf course funding convinces me that local officials have already accepted the rationalization of the apologists.

Only idiots would budget and use one-time cash reserves based upon a forecast of prices heading back up to $100. Instead, the budget needs to be brought into balance with current prices, then if prices ever did go back up toward $90 or even $100 the state could rebuild its cash reserves. Shale oil, periodic weak demand, OPEC changes, and some worrisome trends in China all argue for volatility in energy prices of the sort we see right now. The state needs less ongoing spending and it needs more cash reserves.

Governor Walker campaigned on maligning Governor Parnell for spending $7 million per day more than the state was taking in. That was the mantra and he said he would balance the budget if elected. Now the state is overspending by about $11 million per day. Alaskans have every right to expect from him a budget that balances. If legislators add unsupported spending to that budget then Governor Walker needs to veto that excess spending. That is how the process works, and that is what voters rightfully believe Governor Walker will do.

The heavenly promise of a gasline is silly at best. The world energy climate is today the opposite of what anyone would expect to see if a huge gasline project in Alaska was to be financed and constructed. That is why real, serious people and companies are not present with newspaper ads (very inexpensive today compared with just several weeks ago), lobbyists, Gulfstreams, etc. Instead the administration is swamped with promoters and confidence men who make it to Juneau on Coach Class only because cheap air fares can be had. Some of these fellows actually come from Las Vegas, and some of the people attending the 3rd Floor meetings say they are sorry they didn’t bring their aluminum foil hats.

The trouble with forecasting $100 oil and talking about a gas line is that it makes the downturn all the more severe. Families plan and make investments based upon the promises when instead they should be paying down debt and building personal cash reserves. Cautionary language doesn’t take the forecasters off the hook because it’s human nature to disregard it. Legislators too need little incentive to overspend today based upon the department forecast of higher oil prices and a gas line, and that seems to be where this is headed.

Amen.

Yep, for a long time. A couple of early examples: Alaska Budget Cutting: It’s not rocket science (Aug. 2012), Why Alaska needs to reduce spending (and how to do it) (Alaska Business Monthly, Oct. 2013). Others more recent: Fiscal leadership needed now (Nov. 2014), Alaska Fiscal Policy: The Way Forward (Nov. 2014).

More good news:

Capital spending on the North slope is exploding and is expecting to be about $4.5 billion in FY 16 – up from $2.9 billion in FY 13. This means more money injected into the economy, more jobs, more production, and more revenue.

If we were operating under ACES, with its generous credits that SB 21 eliminated, the state would have no production tax or even a NEGATIVE production tax at today’s prices. The honest people defending ACES or associated with Yes on 1 should be extremely grateful that they lost. Can anyone imagine what Senator W would have said if the revenue source book came out and it said thanks to the repeal we aren’t collecting any production taxes, or worse Exxon has a negative tax rate (See Goldsmith’s ISER report.) Les Gara is outraged that for certain fields, and making certain assumptions like an 8 percent discount rate and excluding all other sources of revenue, SB 21 is NPV negative. Yet ACES wasn’t only NPV negative but it very likely reduced Exxon’s tax bill to below zero at today’s prices given all of the spending at Point Thomson.

What would they say? They told everyone that SB 21 was an unconstitutional giveaway. What they didn’t tell us is that ACES was far worse for the state’s coffers when oil prices were below $105 at today’s costs or $95 if you assume lower costs. Fortunately our press is holding the Yes crowd accountable. Oh wait.

It boggles my mind that given all of the attention SB 21 has received, most people still don’t realize that we get more money at lower oil prices and that the ADN comment section is filled with moronic posts about giveaways and corrupt politicians and nobody is saying, wait, why didn’t Dermot, Bill, Hollis, Vic of Les ever tell us that we get more revenue at lower prices?

Another piece of good news: Cook inlet oil production has doubled and is expected to continue to increase.

Yes. Schools. He was appointed to the Sustainable Education Task Force and made a statement to the effect that if we keep spending money on schools the oil producers will think poorly of us.

He’s also never disclosed his clients.

If you listen to his rhetoric and Google around a bit he is quite literally making statements about Alaska’s budget that Bill Allen made in the years leading up to you know what.

But hey, the media gobbles him up because they are too lazy to think for themselves. And you, read stuff.

Has Brad Keithley ever provided examples of what he believes ought to be eliminated from the state budget?

Are you kidding me?

I was shocked to learn that tobacco taxes take in $17 million more than fish taxes. Tobacco also dwarfs mining taxes.

Fish and mining taxes have not been looked at forever. Both need small increases. To over look this is irresponsible.